Working with different BTR (Build to Rent) operators and helping them with Revenue Management, we see lots of rent setting personas. In this article we describe the Overshooting Rent Setter.

This is a real case study, although we have modified the data so the organisation can’t be identified and so the real data remains confidential. Nonetheless, you should be confident that the quantum of the metrics described in this article are representative of pricing activity which regularly takes place in the BTR industry. Many operators would have experienced a similar sequence of events.

Let me start with a story. I recently went on a dinghy (a small boat) with 4 other people. One of the passengers saw a pod of dolphins only 20m from our boat. As soon as he pointed at the dolphins to his right, everyone moved to that side of the boat. The boat tilted and water started gushing over the side. Everyone had the identical reaction at the same time. “To avoid the boat tilting, let’s move to the left”. So suddenly, all 5 passengers shifted to the left, only to find the boat tilting the other way. And then everyone went to the right again…

The case study below reminds me of the boat incident.

What happened?

| Phase | Activity | Commentary |

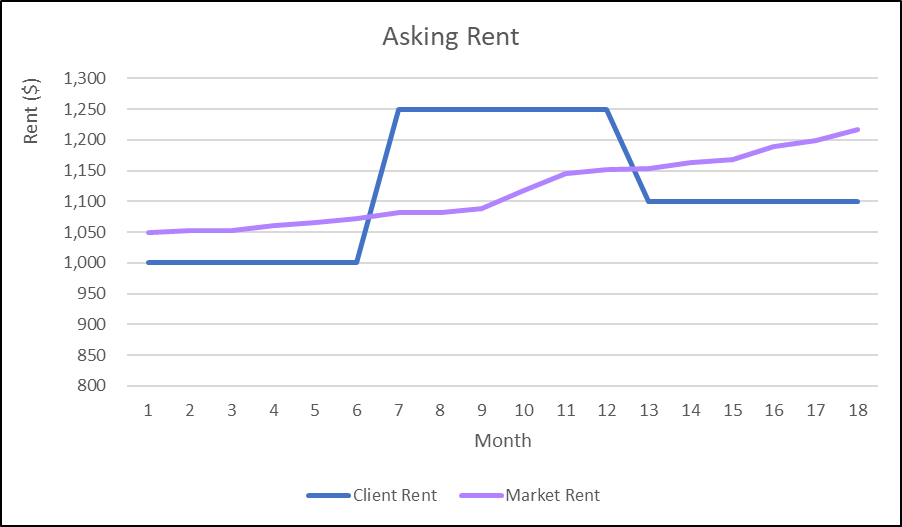

| The Lease Up | Rents were prices slightly below market to ensure vacant apartments would be rented within a reasonable timeframe. The pace of lease-up activity was initially as expected, and slowly increased as market rents rose. | Rents were probably set at about the right level initially. Generally, rents should be increased in the lease-up phase as vacancies are filled. In this case, rents should have been further increased due to the strengthening market. Asking rents had become lower than what tenants were willing to pay. |

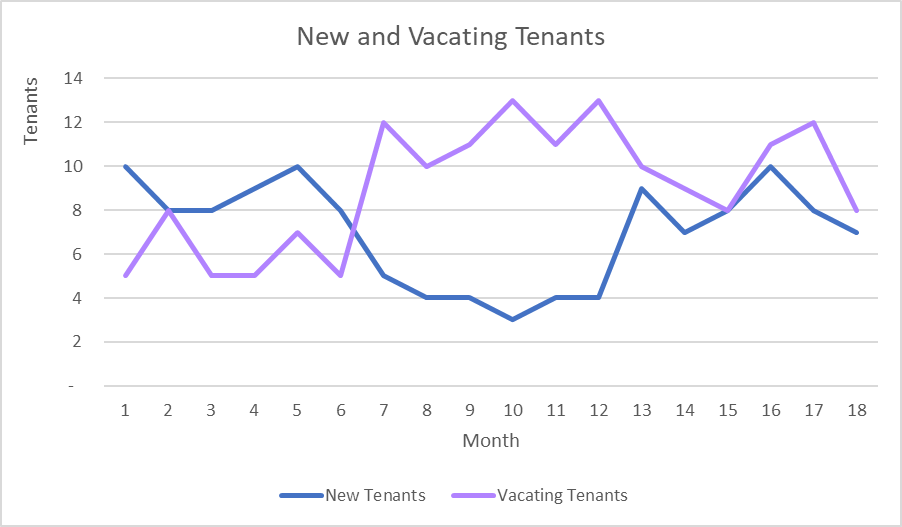

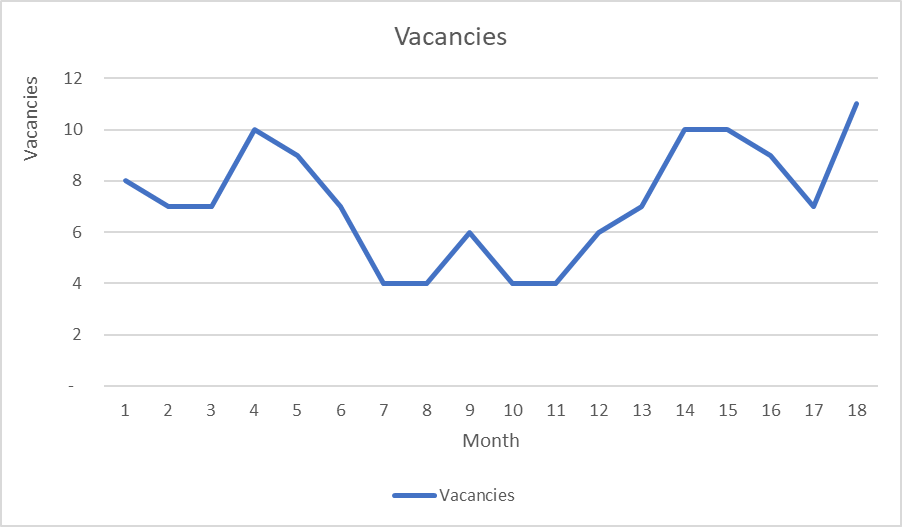

| The Hike | The operator identified that market rents were increasing. It forecast that demand was about to increase further, due to changes taking place in the economy which would impact the local area. In anticipation, rents were increased by 25% across the board. The economic changes weren’t as impactful as anticipated. The number of new tenants per month fell substantially. Existing tenants, whose rents also increased by 25% upon renewal, stopped renewing leases. Vacancies rose significantly. In the meantime, market rents continued to increase, albeit not enough to overcome the declining occupancy rates. | Small, regular rent increases would have provided ongoing feedback as to whether rents were set at the right level. In the absence of such feedback, the operator was forced to guess how far to push rents. In this case, they guessed wrong and overshot. |

| The Slash | With declining numbers of new tenants and increasing vacancies, the operators took drastic action. They slashed asking rents by 12% across the board. In the meantime, market rent increases accelerated. New tenants found the asking rents attractive. Lease termination rates stabilised. And it wasn’t long before occupancy was nearing 100% again. | You can’t blame the operator for reducing rents at this point. The damage was done when rents were increased by 25% and not reviewed for 6 months. The timing of the 12% rent reduction was unfortunate, because just as rents were reduced, market rents were increasing rapidly. Once again, the pendulum had swung too far. |

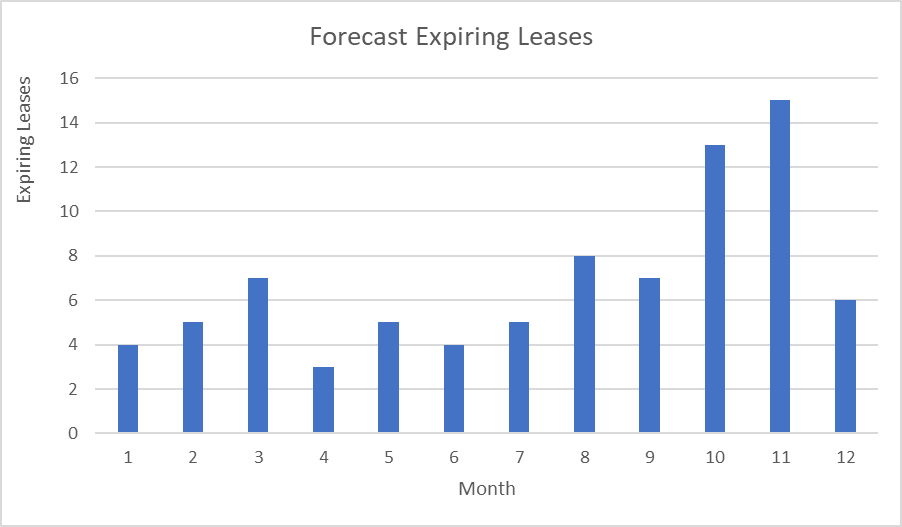

Fast forward and the operator has another looming problem. During the Slash phase, rents were attractive and vacancies were high. A large number of new tenants moved in during those periods and signed cheap 12 month leases. One year later, the operator will have a large number of leases all renewing at the same time, with tenants paying well under market. The operator will face a difficult balance between increasing renewal rents significantly to market levels and having most tenants vacate, versus continuing to receive low rents from those tenants.

Here is a more visual description of activity and metrics.

What can we learn?

There are 3 important take-outs from this case study:

- Adjust rents regularly. If you aren’t updating rents at least monthly then you are leaving money on the table. That means at least 12 rent adjustments every year with no exceptions. When you don’t adjust rents, not only do your asking rents become too high or too low. There are 2 more subtle problems which arise:

a. It becomes harder to analyse your data and set rents correctly

b. You will need to suddenly increase rents which creates unhappy tenants. - Avoid having too many leases expiring at the same time. Here is an article which explains how to achieve this outcome and why it is important.

- When leases renew, carefully consider how much to increase rent on every lease. The optimal rent increase will depend on a range of factors including rents for new tenants, current rent being paid by the existing tenant, market rent increases since the tenant’s most recent rent increase, and tenure of the tenant. Getting this right is one of the most important aspects of pricing for BTR operators.