Today’s article starts with this question: How fast are rents growing in the UK?

The answer is really simple. Even my 10 year old son could answer this question, despite living in a different country and not having seen any data on the topic. The answer is…

… wait for it…

…the answer is…

…drum roll…

…it depends.

Now that was the easy part. The next question is… what does it depend on? The rate of reported rent increases depends on 3 things:

- The geographic region

- The time frame

- Whether we measure new or existing tenants. [Spoiler alert… this is the most interesting part of the article].

Geographic Region

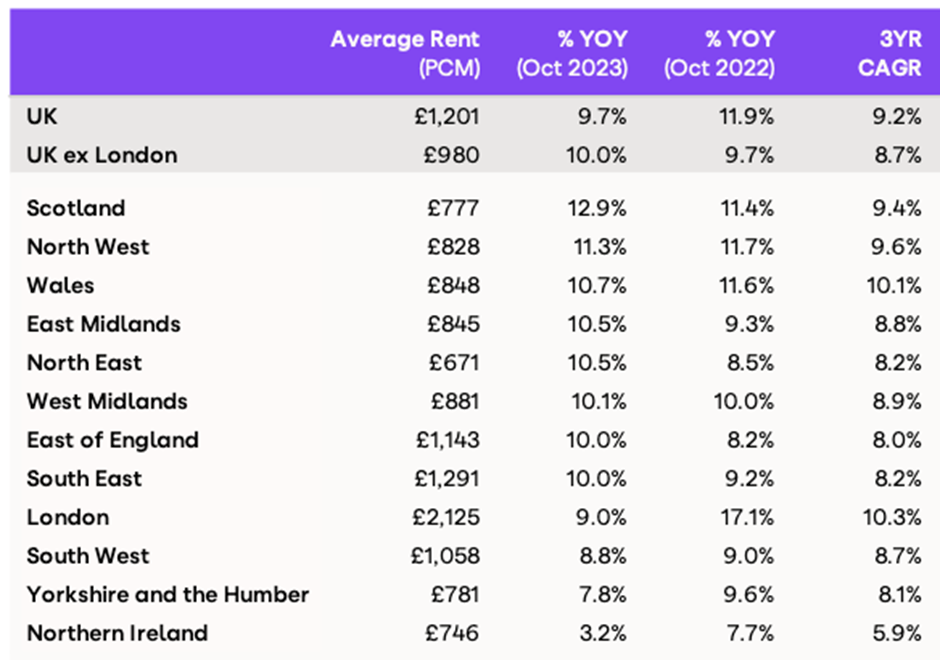

Let’s start with geographic region. As you would expect, rents have grown faster in some regions that others. As Chart 1 below shows, asking rent growth has ranged from 3.2% in Northern Ireland to 12.9% in Scotland. More granular data within each of those regions shows even greater disparity. For example, rental growth in Edinburgh has exceeded 15%, compared with 9% growth in Aberdeen over the same period.

Chart 1: Asking Rent Growth by Region

Source: hometrack.com, zoopla.co.uk

Each geographic region has its own nuances which contribute to the respective growth rates. For example, Scotland has limits on rent increases for existing tenants, a policy designed to make renting more affordable. For this reason, many landlords have been charging more to new tenants, knowing they won’t be able to materially increase rents in the future. What a failure in government policy!

Interestingly, the strong recent growth in the UK has been replicated across most developed countries. It is an outcome of population growth exceeding new housing supply, together with a catch-up from low rental growth from the early COVID period.

Time Frame

Rents increase at different rates over time, due to changes in demand and supply.

The COVID period was a prime example of this. Initially, rents fell due to tenants not being able to afford rent payments (ie reduced demand). Then we saw rents increase as a result of tenants wanting more space (increase demand), combined with material and labour shortages reducing new home completions (reduced supply).

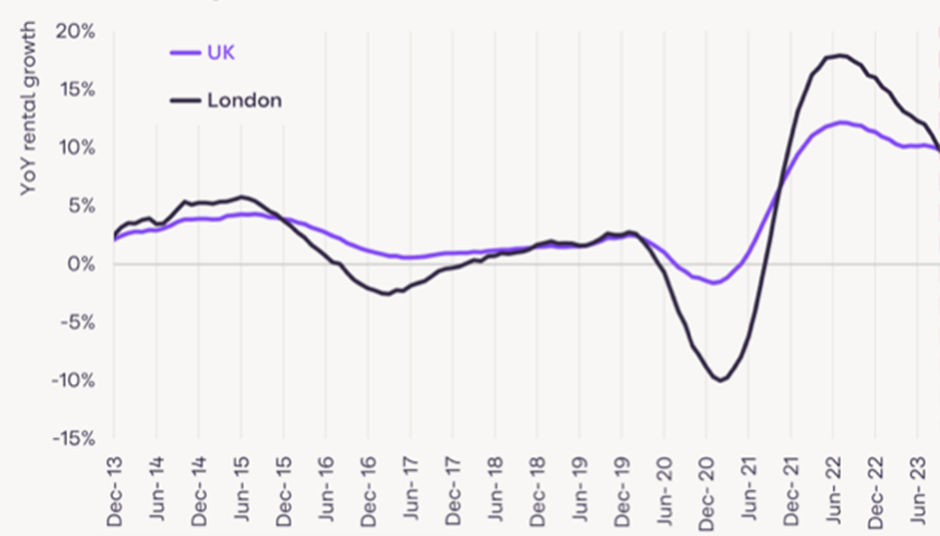

Chart 2: Asking Rent Growth over time

Source: hometrack.com, zoopla.co.uk

Chart 2 clearly shows these movements over time.

Measuring new versus existing tenants

As promised, this will be the most interesting part of the article. [Let us know if you disagree].

Chart 2 showed that the average rental growth over the year to October 2023 was 9.7% across the UK. However, consider Chart 3.

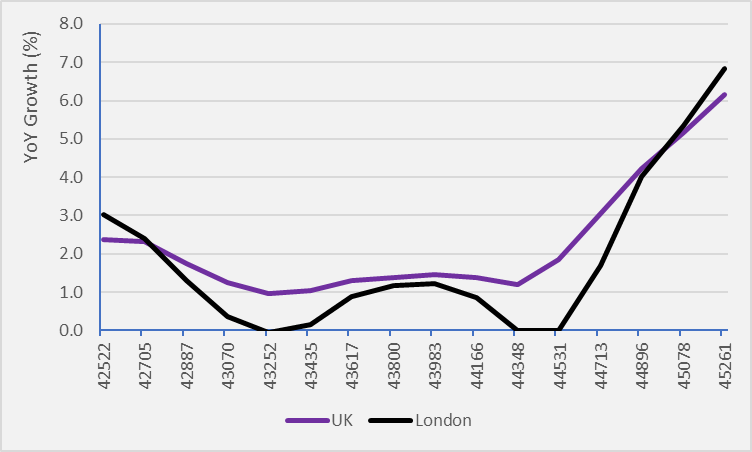

Chart 3: Actual Rents paid by tenants

Source: ons.gov.uk

Chart 2 measured asking rents, ie the advertised rent for new tenants. In contrast, Chart 3 measures actual rents paid by tenants, including new tenants and those tenants renewing their leases. There are some noticeable differences:

- Volatility – Actual Rents are smoother. For example, London annual asking rent growth ranged between about -10% in February 2021 and +18% in July 2022. However, actual rent growth ranged between 0% in January 2022 and +7% in December 2023. As an aside, this measure hasn’t peaked yet. I expect it will peak at around 8-10% in the next 12 months.

- Lag – Asking Rents reflect market changes earlier than Actual Rents. Suppose

demand suddenly increases. This will be immediately reflected with asking rents (for

new tenants) increasing. Over time landlords will increase rents for existing tenants

as well, so eventually the change will be reflected in the Actual Rent Data.

Implications for Build to Rent (BTR) Operators

The implications for BTR operators, and the way they conduct Revenue Management, are profound.

- There are clearly differences in rent increases that can be passed onto existing tenants versus new tenants. Setting rents for renewing leases is a very different proposition compared with setting rents for new tenants. Use the same process for these at your own peril. An important reason for this is anchoring, whereby the tenants’ rent expectations are partly influenced by the rent they are already paying.

- When obtaining market data, it is important to use the right data. For example, if you are benchmarking your YoY rental growth, you might compare with Actual market rent growth. However, if you are normalising for changes in market rents, then you should use asking rent which reflects the comparison set your tenants are considering.

3. In a market where asking rents are increasing at a slowing rate, as we may experience over the next 1-2 years, you may still be able to pass on strong “catch up” rental increases to existing tenants. However, there is a fine line on how far how far you can push this. Get it wrong and you risk making the common mistake described in this article.

“Setting rents for renewing leases is a very different proposition compared with setting rents for new tenants. Use the same process for these at your own peril.”

Through collection of market data, Price Wizard has developed a strong understanding of tenant behaviour across a range of scenarios. We know how far you can push the envelope, enabling our clients to confidently adjust rents for renewing tenants without pushing those tenants over the edge.

Would you like to update rents on renewal with increased confidence? Schedule a demo with Price Wizard.